Eleven years after it was founded, Flipkart was acquired by Walmart in 2018 for a staggering $16 Bn. And as the ecommerce giant closes in on two decades of retail innovation in India, it’s preparing for another major milestone — an IPO.

This past week, ecommerce major Flipkart from Singapore after months of speculation. This kicks off the first of the steps needed for Flipkart to finally hit the IPO milestone.

It’s too early to tell when Flipkart’s train would stop at the Bombay Stock Exchange just yet, but we know that it is closer than ever before. The last major step from a compliance point of view was to reverse flip to India, but the company’s statement about its commitment to India comes at a very curious point in time, given the current geopolitical climate.

This Sunday, we will delve into that and how Flipkart is getting ready for its public debut by blitzscaling the quick commerce business. But first, a look at the top stories from our newsroom this week:

- Indian startup investors are groping in the dark to understand the impact of the US’ tariff decision on the country, while many see a glimmer of hope in manufacturing

- For Jumbotail, the Solv acquisition could be a big lifeline as the company has struggled to raise funds since 2021 and was too heavily reliant on grocery supply, but the speculated valuation of the combined entity has raised some red flags

- Legacy players like Bajaj and TVS have overtaken most EV startups, leveraging superior manufacturing, supply chains, and brand equity, while startups, once promising, are struggling to maintain momentum

“As a company born and nurtured in India, this transition will further enhance our focus and agility in serving our customers, sellers, partners, and communities to continue contributing to the nation’s growing digital economy and entrepreneurship. We are excited by the opportunities ahead and reaffirm our long-term confidence in India’s future,” Flipkart proclaimed in its statement this week.

But this comes just a day or so after Walmart and Amazon became a subject of discussion between the US and India over a trade agreement, according to a Financial Times .

The report claims that the current US administration could press India to completely open up its ecommerce market for international players. This is said to be part of the framework for the India-US trade deal that is expected to cover multiple sectors, including food and automobiles. As per current rules, ecommerce companies with FDI can only function as a marketplace in India and cannot own inventory.

The rules are, however, different for Indian-owned companies, which has been a major challenge for Amazon and Flipkart, who even had to take some of their products offline when the rules last changed in 2019. Will the new trade talks result in some of these restrictions being lifted?

Flipkart’s announcement to redomicile to India takes on a different hue in this light, though it must be said that Amazon and Walmart have engaged with regulators in the past as well without much success.

As part of the reverse flip, Flipkart could be staring at a hefty tax bill. For context, Walmart-owned PhonePe had to cough up $1 Bn in taxes to shift its domicile back to the country. For Flipkart, which is one of the highest valued startups in India and was last pegged at $36 Bn, the tax outgo could likely be much higher.

Walmart will undoubtedly have to foot a huge part of that tax bill in the months to come. But the Flipkart parent is not shy about investing in the company. Just this year alone, the Indian operations have received nearly $500 Mn in infusion from Walmart, which owns over 85% of Flipkart.

The company is speculated to be eyeing a $70 Bn valuation when it lists, which is more than a 3X bump from Flipkart’s valuation of $22 Bn in 2018, when Walmart acquired its majority stake.

Flipkart’s Quick Commerce MinuteThis capital infusion forms the company’s warchest for the quick commerce slug fest, where Flipkart Minutes debuted last year.

Flipkart CEO Kalyan Krishnamurthy said Flipkart Minutes currently and is targeting an 800-strong store network by the end of 2025. That will undoubtedly require aggressive investment from Flipkart as well as spending to acquire users in new cities and regions.

Krishnamurthy added that in India, the affluent consumer segment in the top 30-40 cities has developed a propensity to engage with ecommerce with expectations of short delivery timelines. This has compelled significant investments from all players to expand their network.

Flipkart’s entry in the quick commerce segment , but the company hasn’t had to spend time in creating awareness about the service or convenience, which was already established by Eternal-owned Blinkit, Zepto and Swiggy Instamart.

But the late entry has in many ways forced Flipkart to accelerate faster than the incumbents. Eternal’s Blinkit has a network , while Zepto claimed to be operating a network of 700 dark stores at the end of 2024. Swiggy’s Instamart had a network of 705 stores at the end of the calendar year.

Despite its bullishness and its ambitious expansion targets, Flipkart faces an uphill task in the quick commerce vertical. For instance, JP Morgan noted that other companies may be slowing down and focussing on profitability from a smaller base of stores instead. Zepto’s slower pace of dark store addition in January and February was one example cited by the brokerage.

Further, it must be noted that all three quick commerce majors are facing significant cash burn as they look to expand their reach.

Walmart’s fund infusion into Flipkart will solve this to a large extent, but if the IPO is indeed coming by 2026-end as many expect, Flipkart Minutes will have to move on very quickly to profitable growth from cashburn at the end of 2025.

The reverse flipping is important from the point of view of quick commerce too, where most players expect stricter enforcement of rules pertaining to FDI for multibrand retail. Eternal and Zepto in particular have looked to clean up their cap table and add more domestic investors to their shareholder base in recent weeks.

Flipkart redomiciling to India would make it easy for the company to address potential problems in terms of FDI compliance under Flipkart Minutes as well.

Flipkart Is In No HurryHaving said this, there’s actually little pressure on Flipkart to go for an IPO now. The deadline is tighter for the reverse flip.

Indeed, Walmart has always maintained that it is ultra patient when it comes to the listing of both PhonePe and Flipkart. Flipkart already saw major exits that delivered returns to its investors.

“Walmart is the largest shareholder in Flipkart. Other companies have the IPO pressure because they need to provide exit to investors. Walmart never put Flipkart in this position and it has immense patience. The group knows Flipkart will deliver when the IPO comes eventually,” one former Flipkart CXO and an insider told Inc42.

Others such as OYO are definitely being put on a deadline for an IPO and in the past, SoftBank had given Paytm a similar short rope for a public listing as a condition for its last round of infusion. Flipkart, on the other hand, is in a position of luxury and one that not many startups would be familiar with.

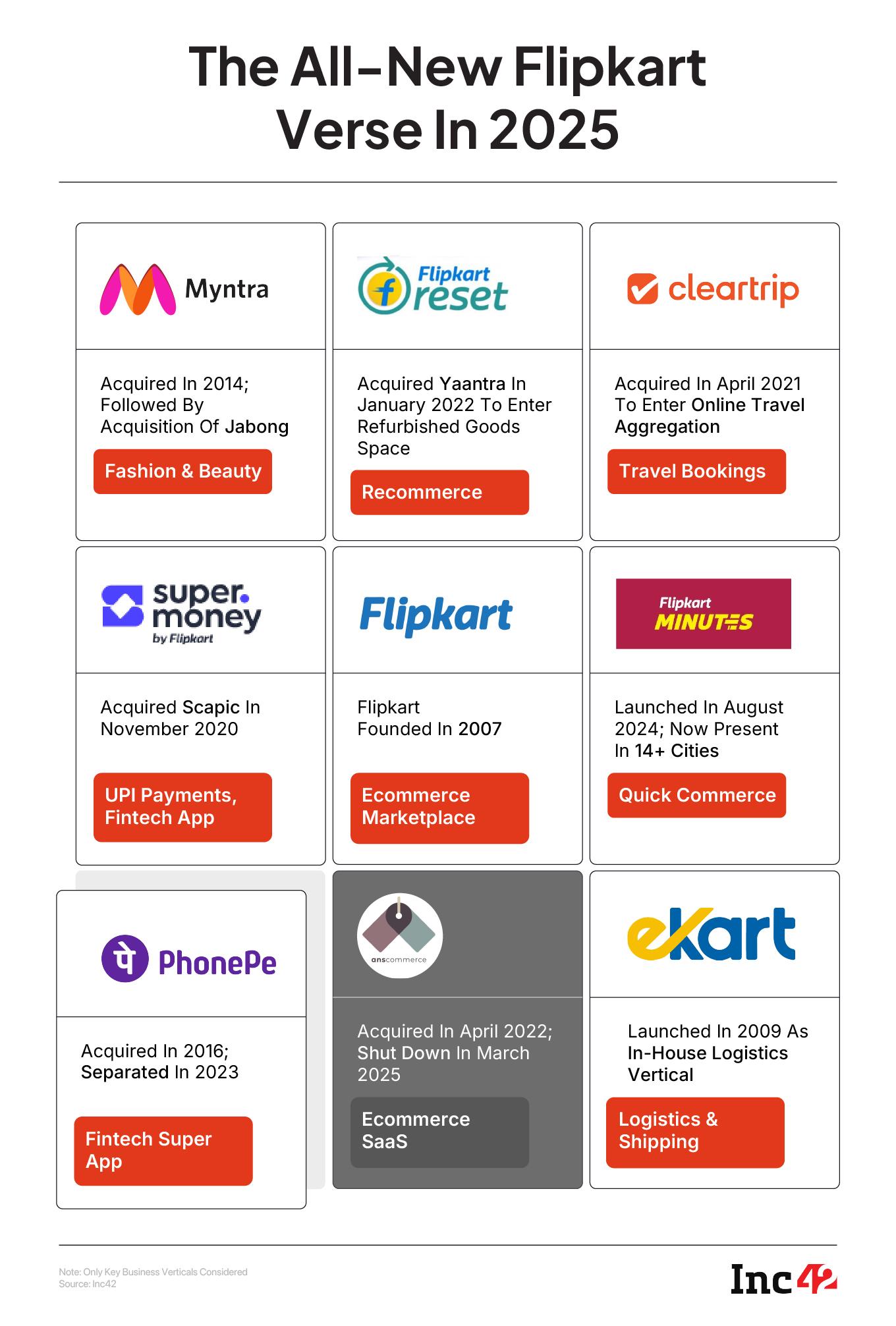

Flipkart CEO Krishnamurthy at the ecommerce firm after a host of vertical heads, including that of travel booking platform Cleartrip, fintech payment app and growth initiative heads stepped down last year.

As we have previously reported, the company also trimmed its workforce by 5%-7% reportedly through a performance review exercise. The Flipkart leadership, particularly the SVPs, have been under tremendous pressure since last year to deliver results and that might have caused large-scale exits at senior levels.

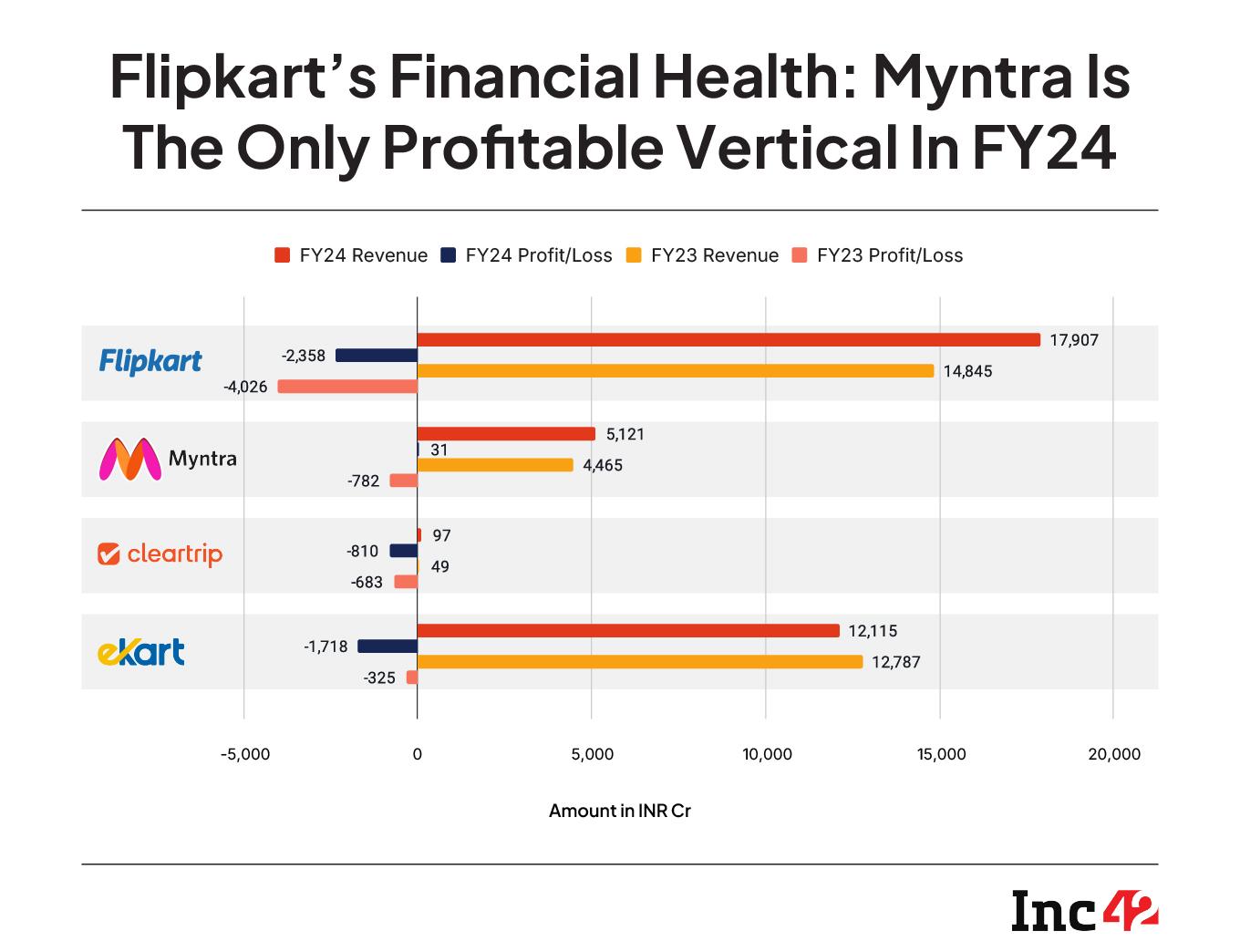

The ecommerce major has looked to ensure that most of its subsidiaries reach break-even levels as the company is eyeing a strong bottom line. Overall, Flipkart grew its top line by 21% to in FY24, while it shrank its loss by 41% to INR 2,258 Cr.

Krishnamurthy told the employees in a townhall earlier this year that the company was inching closer to profitability with cash burn going down significantly on a month-on-month basis.

Walmart is known to play the long game when it comes to financial upside and everything points to the company’s grand plan for Flipkart coming to fruition in the near future.

The challenge Flipkart faces is balancing the costs while expanding its quick commerce business and aiming for an IPO, which requires some degree of focus on the bottom line. Will the ecommerce giant find the middle ground?

Sunday Roundup: Startup Funding, Deals & More- Used car marketplace Cars24 has laid off around 200 employees across various departments as part of its restructuring exercise aimed at streamlining operations

- This past week (April 21 and 26), Indian startups bagged $100 Mn across 18 deals, which is higher than the previous week, but there’s definitely some slowdown in the past two weeks

- Venture capital giant Peak XV Partners is planning to raise its first independent fund since splitting with US-based Sequoia Capital two years ago

- The ED reportedly detained BluSmart cofounder Puneet Singh Jaggi from a hotel in New Delhi today after raids at Jaggi’s Gensol

The post appeared first on .

You may also like

Everyone who can automatically get a disabled parking Blue Badge - full list

The little-known UK beach with hidden cove and seals you can spot year-round

UK's incredible Petrifying Well phenomenon that can turn objects into stone

Horrifying documentary 'everyone needs to see once' that led to hostage crisis

The 'entitled' cruise faux-pas that's as bad as reclining your seat on a flight