Ola Electric can’t seem to catch a break. A few days after the Bhavish Aggarwal-led EV maker , data for the month of May suggests that it has lost its second spot to Bajaj Auto in the electric two-wheeler (E2W) market.

Overall, E2W registrations across the country grew a modest 4% to 96,114 units in May from 92,387 units in April. On a yearly basis, May’s registrations were up over 24%.

Who’s The Winner & Who’s The Whiner?

TVS registered 23,704 units in May, up nearly 19% MoM

The sale of Bajaj Chetak escooters shot up 8% MoM to 20,756 units

The sale of Bajaj Chetak escooters shot up 8% MoM to 20,756 units

Hero MotoCorp’s Vida brand shot up over 9% MoM to 6,724 units

Hero MotoCorp’s Vida brand shot up over 9% MoM to 6,724 units

Ola Electric’s registrations declined over 9% MoM to 17,947 units

Ather Energy saw a 7% MoM decline in registrations to 12,323

Ola Electric’s Falling Graph: The EV maker saw a MoM decline in sales for the second consecutive month in May. Notably, the OEM has been plagued by losses (up 109% YoY to INR 870 Cr in Q4 FY25), , discrepancies in sales reporting, and and driven customers towards alternative options.

However, things may soon change for Ola Electric, which has recently . If the product is able to woo the commuter vehicle market, the company, in all likelihood, will be able to bounce back strongly.

But, for now, Ola Electric’s registration numbers are on a retreat, and new-age tech OEMs are getting frantic to stay in the race now being dominated by legacy automakers. So, what do May’s E2W registration numbers say?

From The Editor’s Desk: The B2B ecommerce giant has marked the final close of its Series G funding round. It secured $75 Mn from M&G Prudential and Lightspeed Venture Partners in the first tranche, while it bagged $39 Mn in the second.

: Union minister HD Kumaraswamy has said that Tesla is currently not interested in manufacturing in the country. This comes as the Centre finalised the new EV policy, allowing OEMs that “Make In India” to import certain EV four-wheelers at 15% customs duty for five years.

: The contract manufacturing company has filed its DRHP with SEBI via the confidential pre-filing route for a $200 Mn IPO. This comes days after it turned into a public entity. Aequs manufactures parts for the aerospace, toys, and consumer goods industries.

: The ecommerce major’s shareholders have approved a proposal to issue the bonus shares as it gears up to file its DRHP. Meesho is looking to raise nearly $1 Bn through its IPO, slated for 2025-end, at a $10 Bn valuation.

: The D2C furniture brand’s board passed a special resolution to issue 5.59 Lakh Series 12A CCPS at an issue price of INR 775 each. It is raising the capital from existing backers General Electric, Norwest Venture Partners and Goldman Sachs.

: The Maharashtra food and drug administration has revoked the food business licence of the quick commerce major’s warehouse in Mumbai’s Dharavi. This came after an inspection found serious food safety violations at the warehouse.

: The Vietnamese EV major is looking to boost its annual electric vehicle production to 1.5 Lakh in India in the coming years, with an eye on exports. The company is also “optimistic” about hiring up to 3,500 employees across India by 2030.

: The D2C apparel brand has raised the funding in its Series B round led by 360 ONE Asset, with participation from IvyCap Ventures, SWC Global and Ravi Modi Family Office. The startup has raised $13.4 Mn to date.

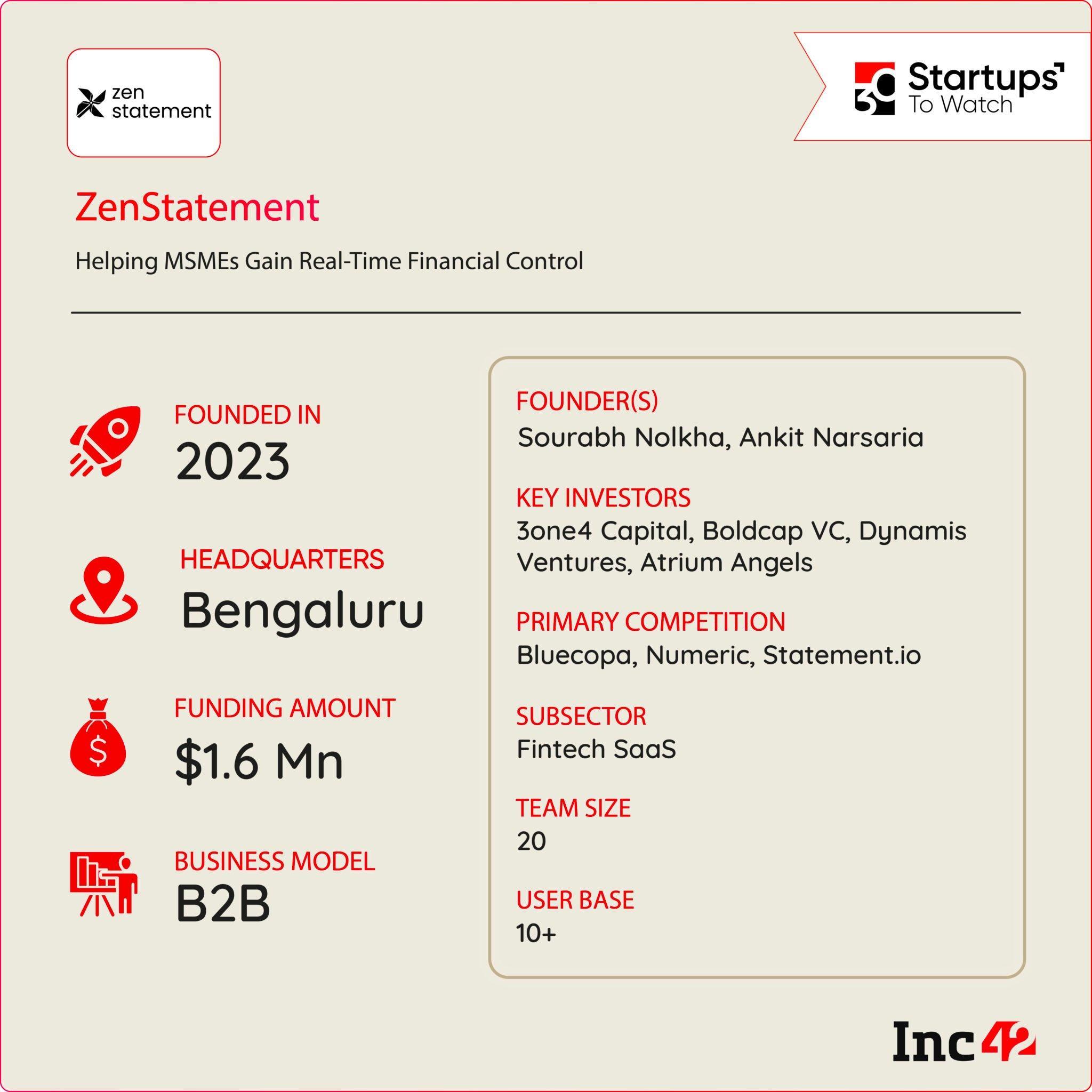

Inc42 Startup Spotlight How ZenStatement Is Automating Finances For Indian SMEsSmall businesses in India struggle with operational inefficiencies in financial management, largely due to manual processes, fragmented data, and the absence of automated tools for reporting and analysis.

Recognising these pain points, Sourabh Nolkha and Ankit Narsaria founded Zenstatement (erstwhile known as SimpliFin) in 2023.

Real-Time Financial Visibility: The Bengaluru-based SaaS platform’s collection management tool enables faster and more accurate collections while its payout management system simplifies complex payouts through improved validation and automation.

It also helps SMEs gain real-time visibility into their financial data and offers actionable insights. This forecasting enables its clients to identify gaps in their financial operations, allowing for better control and growth.

Growth Path: The startup claims to have processed $10 Bn in transactions and saved 30% of its clients’ time by automating their processes.

Locking horns with TallyPrime, Finastra, Trillium Cash,

The post appeared first on .

You may also like

Michael Carrick was undervalued by England but FA should keep an eye on him despite sacking

Continuously taking steps to promote use of eco-alternatives to single-use plastic items, India stands committed to ambitious climate action: Bhupender Yadav

Psychic dubbed 'Japan's Baba Vanga' issues terrifying prediction for 2030

Love Island to show sex scenes for first time ever - as Islanders divided by new rule

BJP MP Brij Lal demands Sindoor Memorial for Pahalgam terror attack victims