Reliance, Reliance Jio and Reliance Retail may have a strong hold on many sectors and segments, but quick commerce is a success that has eluded Reliance JioMart so far.

All that could change this year, as Reliance JioMart to make things difficult for Blinkit, Zepto, Swiggy Instamart and Tata’s BigBasket, Flipkart and others in the quick commerce wars.

We tried to go beyond what Reliance Retail’s CFO Dinesh Taluja in the earnings call. Industry experts and those working with Reliance on the ground have given us a peek at how Reliance JioMart could win the game.

Before that, as usual, a look at the top stories from our newsroom this week:

- Amid the BluSmart-Gensol saga, which has become the new focal point around startup corporate governance lapses, the downfall of Log9 Materials has largely gone under the radar. Here’s how the startup fell from deeptech glory

- Elevation and MS Dhoni-backed Rigi has pulled the plug on its core finfluencer platform a few months after relaunching it, and is now focussed on the beauty creator ecosystem. Is this the company’s last lifeline?

- The April edition of Inc42’s monthly startup watchlist is here with our selection of the 30 of the most promising early-stage startups in the country, with the bulk coming from hot sectors like AI, biotechnology, gaming and electric vehicles

It’s easy to forget that this is Reliance Retail’s second brush with quick commerce. The reboot comes after JioMart Express fell apart in 2023 after being launched in 2022. At that time, the company chose the dark store model to launch and test quick deliveries, but now it’s betting on the massive retail footprint.

But a fundamental challenge persists: can a legacy retail giant compete with the speed, consistency, and customer experience of agile, tech-led players like Zepto or Blinkit? Is scale alone enough to defeat these frontrunners in the quick commerce space?

“Free shipping and scale may win early traction, but if Reliance does not address real-time inventory sync, fulfillment accuracy, and app experience, this will be another costly experiment masquerading as a comeback,” according to an investor in a quick commerce startup.

Reliance has 20,000 stores across India, with manpower and infrastructure in place, but its current stores aren’t designed like dark stores, nor are they structured for packing and moving, but more for browsing. Many are in malls or places not suitable for 10-minute delivery logistics.

Reliance Retail’s challenges will be renovating its infrastructure and stores for the quick commerce business. That’s perhaps why it’s taken the company so long to compete.

Satish Meena, founder of market research and forecasting platform Datum Intelligence, told Inc42, “JioMart benefits from the large number of walk-in customers at Reliance’s physical stores. Many of them choose these stores because they’re close to home, offer competitive pricing, or have good product quality. But some of these customers also want the option of getting their groceries delivered at home.”

Beside this, Reliance has a few strong advantages such as massive scale. Being the biggest grocery buyer in India, gives it significant negotiating power with suppliers, Meena added.

But today, quick commerce is not just about delivery — the segment’s largest players need to think about user density, discovery, mix of grocery and non-grocery, customer service, retention and more. Many of those we spoke to say that Reliance has not shown enough outside of AJIO to justify any confidence from the market yet.

Reliance JioMart Bets On HybridIt’s not just its own failures at quick commerce thus far that would hurt Reliance Retail. Unfortunately for the conglomerate, its strategic investment in Dunzo also fizzled out. Quick commerce has been a particularly prickly thorn for Reliance Retail.

While Dunzo’s own troubles came from its inability to hit the right performance metrics in quick commerce, one serious problem was the hybrid model practiced by the company. It had deliveries from physical stores and a separate dark store-centric section in its app.

Reliance is likely to adopt the same approach, but while Dunzo had little control over its partner stores’ inventories, Reliance will have full control. So to be clear, there are obvious differences, but so far dark stores have proven to be the best way to scale up quick commerce.

Today, Dunzo has shut down and it remains as a lesson about how a hybrid model has failed. But Reliance is clearly bullish.

On Reliance’s hybrid model, experts believe that stores and online platforms might end up competing for the same stock when running through one physical store. Customers may walk in and take a product off shelf when it shows as available online.

“The promise of 10-minute delivery only works if you have full control over the dark store and the delivery process. That’s why most players are now moving to open dedicated dark stores — the older model led to fulfillment issues,” he added.

Integrating stores and apps is key. JioMart cannot rest on its parent company’s brand power, it needs to match the app and UX standards set by Blinkit, Instamart and Zepto.

Given that Reliance Retail already has a number of FMCG brands under its umbrella, it will have more leverage on discounting and sourcing compared to the pure-play quick commerce players. “And we have seen with Blinkit, how it is struggling for profitability. Reliance Retail itself is profitable and in a hyper growth mode. It can also sustain its quick commerce venture with its capital backing. The pressure of profitability is not on Reliance and that’s a win” a Bengaluru-based analyst told us.

But again, the challenges are not easy to overcome. One insider at Reliance believes that the existing store infrastructure is a major advantage. “But operational subtlety is the real challenge — walking the line between walk-in footfalls and online fulfilment without disrupting the experience,” they added as a caution.

Fulfillment is one area that’s significantly hard to scale up across multiple cities. Even Blinkit admitted to having a shortage of quick commerce delivery riders in many cities this past week.

Multiple drivers delivering orders for JioMart currently told us that the products are currently being sorted and packed at Reliance-owned Smart Bazaar stores. Incidentally, the acquisition of Future Group’s retail assets was a key factor in growing the Smart Bazaar network.

At the moment, deliveries are happening through fleet operators like Grab, and on average, each order takes 15 minutes to be delivered. However, Reliance’s scale is limited.

Meena added that JioMart is experimenting with online delivery through around 38 stores, catering mainly to their existing walk-in customer base. “Reliance is monitoring this carefully to see what percentage of these customers gradually shift to online ordering.”

Of course, the depth of competition is the largest impediment in Reliance’s way right now. After four years of operations, quick commerce players are still investing heavily in growth and profitability is not within anyone’s grasp.

Blinkit’s adjusted EBITDA loss widened over 381% YoY to INR 178 Cr in the March quarter on account of accelerated investments in expanding the quick commerce dark store network. Blinkit added a record 294 new stores in Q4 FY25, and while Reliance is not going to have to spend this amount, its advantage in owning inventory might not last long.

Zomato, Zepto and others are looking to bring in more domestic investors to ensure they too can own inventory for quick commerce. In this case, it seems that Reliance is arriving late and the existing players have enough moats and advantages to not yet be worried about the retail giant.

That tune may change by the end of the year, if Reliance’s twist on quick commerce pays off.

Sunday Roundup: Startup Funding, Deals, Controversies And More

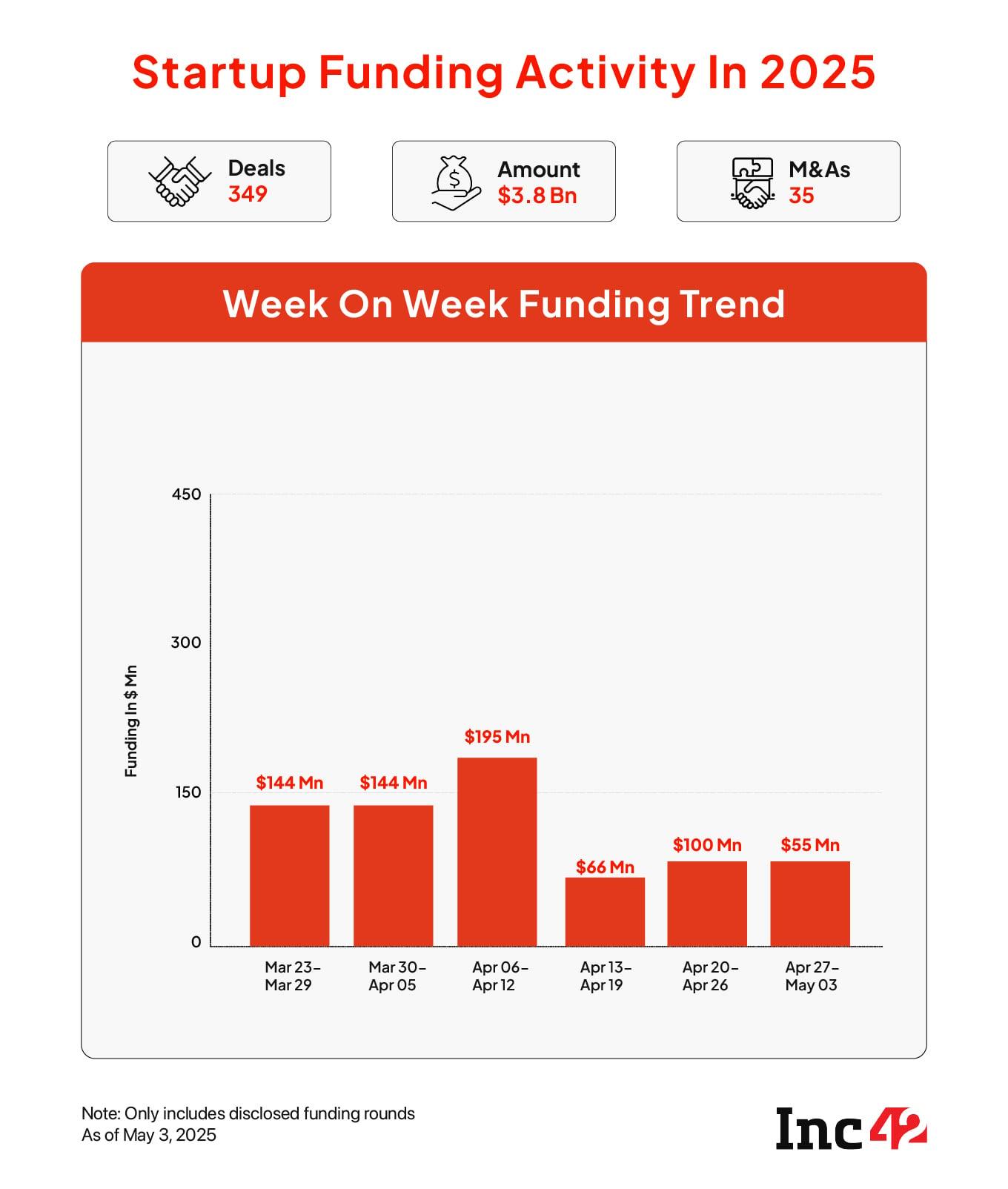

- Between April 28 and May 3, Indian startups managed to raise a mere $54.7 Mn across 15 deals, down 46% from the $100.3 Mn raised by 18 startups last week.

- Amid mounting backlash on social media, OTT platform Ullu has delisted controversial reality show House Arrest, hosted by actor Ajaz Khan, over its “explicit” content and visuals

- Ola Electric has delayed deliveries of its electric motorcycle range by a month, after telling regulators last month that it would be delivering the bikes by April when questioned about its sales claims

- Finnish smart ring company Oura has won a preliminary legal victory against Bengaluru-based healthtech Ultrahuman in a patent infringement case in the smart ring category

- BluSmart’s 10,000 drivers, left jobless after fraud charges grounded the EV company, plan protests in Delhi to voice their plight

The post appeared first on .

You may also like

The beautiful Italian city named one of the world's 'best' and without crowds of tourists

Five flowers any gardener can grow 'easily' with no experience

India focuses on its strengths in Africa, not competition with China: MEA

PM Lawrence Wong's PAP wins 87 of 97 seats in Singapore General Election

NEET aspirant dies by suicide in Kota; 14th case since January 2025