The Indian public market is at an inflexion. While the bull run has paused and valuations have cooled, a more mature, earnings‑driven phase is taking shape. Motilal Oswal head of equity and derivatives Ankit Mandholia believes this sideways movement isn’t stagnation, but a foundation for the next leg of sustainable growth, built on fundamentals.

A Turning Point: The days of “growth at any cost” are fading, giving way to a more measured pursuit of profitability and transparency. Startups looking to list are now being judged by balance sheets and governance controls, not just market buzz. Even SEBI’s reforms – faster approvals and richer disclosures – are signalling an era of cleaner, data‑driven capital formation.

Domestic Strength And Global Scrutiny: India has evolved from an FII-dependent to a domestically powered market. Domestic SIP inflows, exceeding INR 20,000 Cr a month, and rising retail participation now anchor the market, cushioning global selloffs. With a growing GDP, policy stability and rising household confidence in equities, the next phase of wealth creation, as per Mandholia, will hinge on earnings rather than hype.

The Decade From Now: As India’s markets focus more on longevity, Mandholia believes that investors will seek durable metrics – brands that innovate responsibly, list sensibly, and deliver sustainably. He has one mantra for founders chasing the public market spotlight: storytelling sells the IPO, but only governance sustains it. As the market matures, will the companies that fuel it do the same? Let’s find out…

From The Editor’s Desk- Three months after capping its Gigafactory expansion at 5 GWh, Ola Electric has now changed its course and is targeting 20 GWh by FY27. The EV maker sees this leap as a shift from being just an EV maker to becoming a broader “EV + energy” enterprise.

- Its new anchor battery energy storage system is positioned to power this pivot, with projected revenue of INR 1,000–2,000 Cr by FY27. The move appears strategic – diversify beyond the flat EV sector while buying time for profitability.

- From once commanding a 50% share in the E2W segment to being piped by rivals, Ola Electric has been hit by market saturation, high cash burn, shoddy after-sales and a string of adverse regulatory developments.

- The managed workplace provider slashed its net loss 43% YoY to INR 29.9 Cr in Q2 FY26 on the back of a 39% YoY jump in operating revenue, a tax credit of INR 8.8 Cr and sharper financial discipline.

- The company’s assets under management increased 17% YoY to 9.1 Mn sq ft, along with the addition of about 30,000 seats during the September quarter. It also added 21 new centres, taking the total count to 125 centres with a presence in over 16 cities.

- Besides managed workspaces, the company has now forayed into selling and generating solar energy, a move to monetise sustainability.

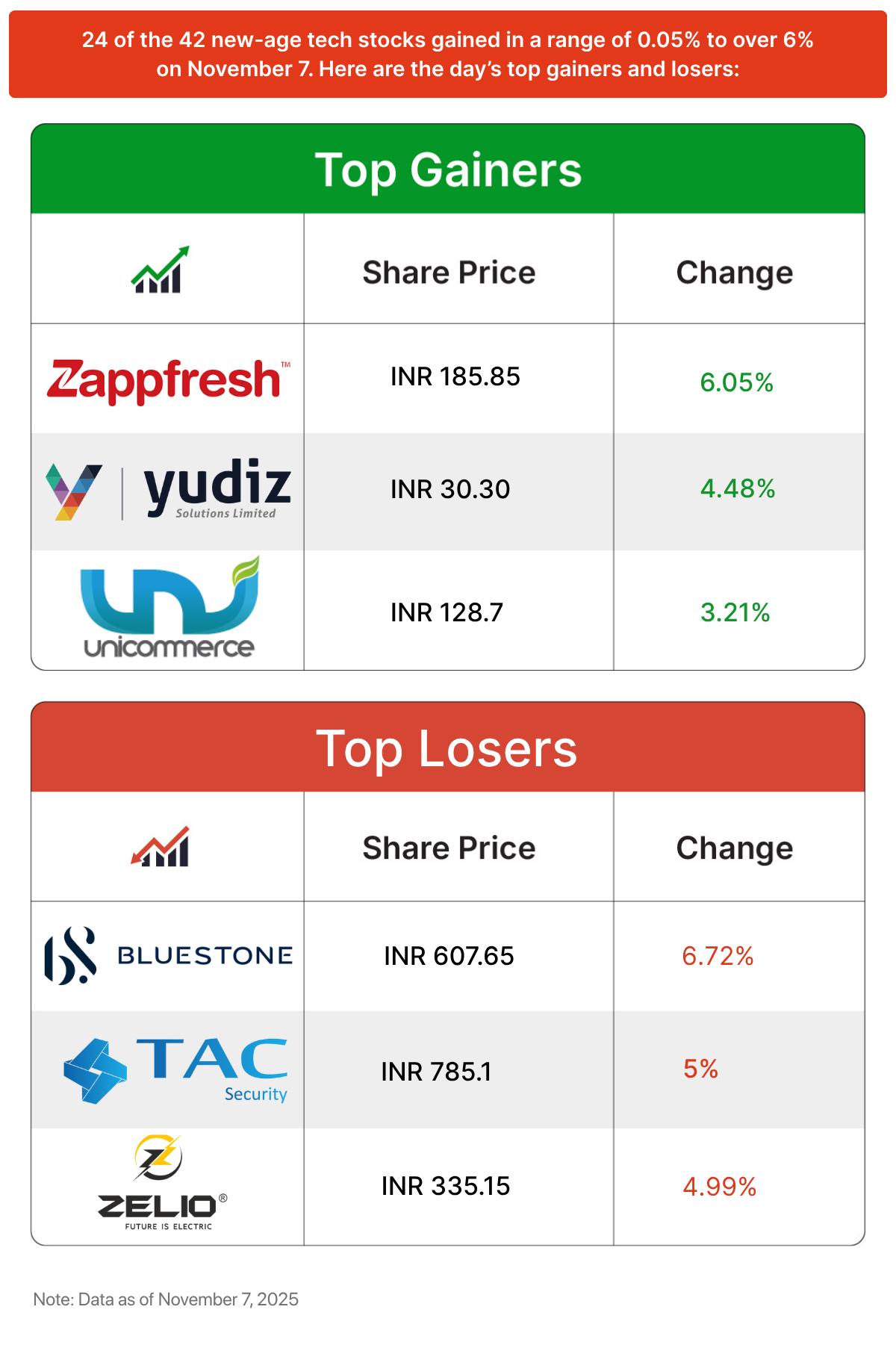

Bear Grips New-Age Tech Stocks

Bear Grips New-Age Tech Stocks - Thirty-two out of the 42 new-age tech stocks under Inc42’s coverage ended last week in the red, declining between 0.12% and over 14%. BlueStone was the biggest loser, while TBO Tek emerged as the biggest gainer.

- The total market cap of new-age tech companies fell to $106.42 Bn from $109.15 Bn in the preceding week.

- Largely to blame for this were FII outflows, muted global cues, and profit booking in heavyweight stocks. Weak Q2 results also contributed to the decline in new-age tech stocks.

- Indian startups cumulatively raised $237.8 Mn last week, down 36% from $371 Mn raised in the preceding week. MoEngage and Giga bagged the biggest cheques at $100 Mn and $61 Mn, respectively.

- While enterprise tech remained the most funded sector, AI startups continued to see strong investor interest as six AI startups raised $67.6 Mn last week.

- A91 Partners and Sauce.vc emerged as the most active investors last week, backing two startups each. Seed stage funding also rose 52% week-on-week to $11.9 Mn.

- MIXI Global Investments, Nazara Technologies, and Chimera VC have joined hands to launch LVL Zero, an incubator aimed at nurturing India’s next generation of gaming startups.

- Under the initiative, the trio will select ten startups per cohort, each receiving $10,000 from a $100,000 equity-free pool. Over the next five years, LVL Zero aims to support 100 early-stage gaming startups through mentorship and guidance.

- The launch comes amid the recent clampdown on the real-money gaming sector, which has cast uncertainty over monetisation models and hit sector sentiment.

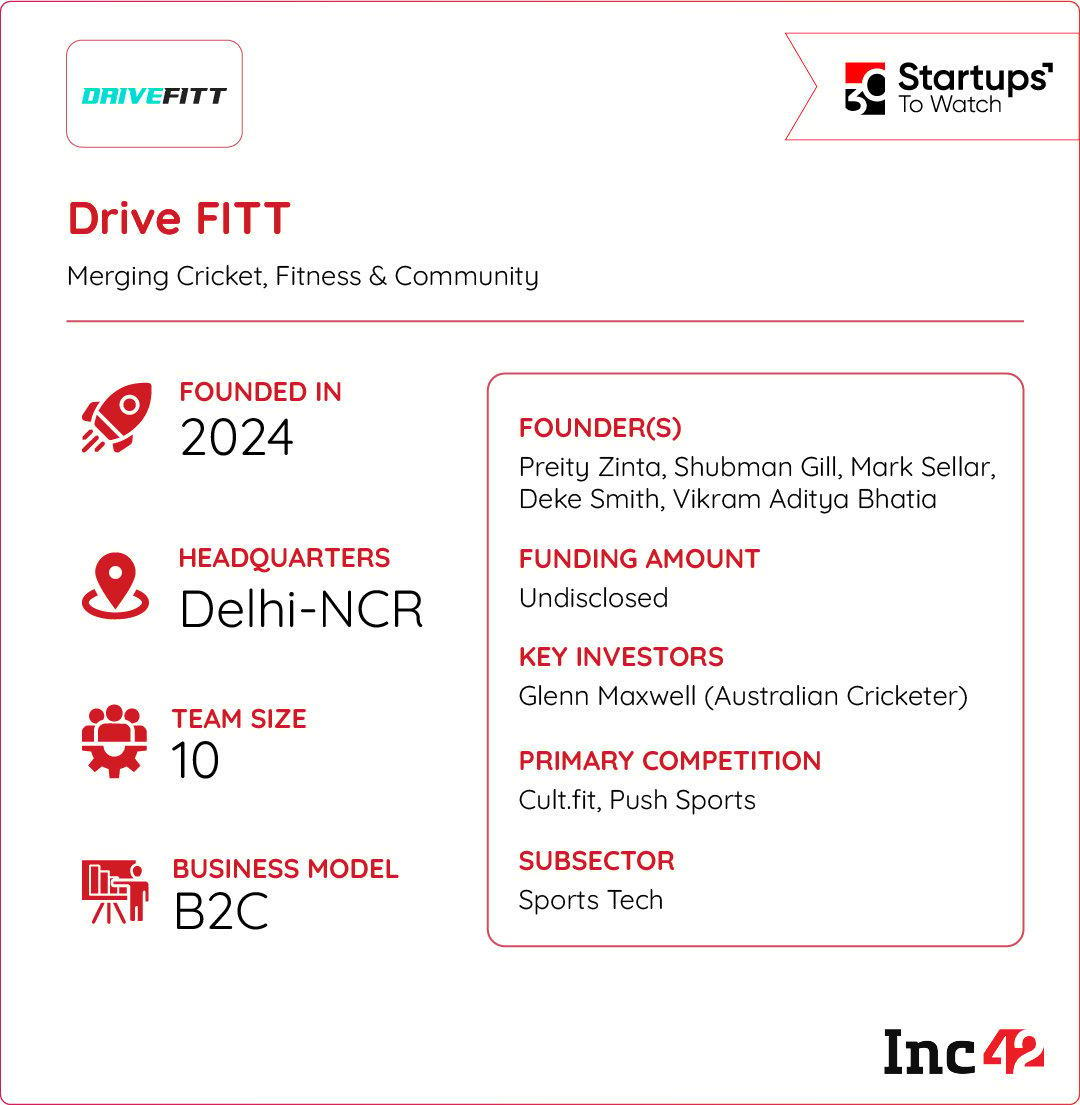

Traditional gyms often fall short, lacking motivation, structure, and a holistic approach that seamlessly blends sport, strength, and recovery. Enter DRIVE FITT, a startup that’s redefining fitness by combining the spirit of cricket with a unique sports club experience.

A Holistic Solution: Founded in 2024, DRIVE FITT is a 24/7 sports club that combines cricket training, gym workouts, yoga, and elite recovery services under one roof. Its integrated approach caters not just to athletes but to fitness enthusiasts looking for variety and community.

A Premium Bet: DRIVE FITT aims to position itself as a premium brand in the fitness category. With ambitious plans to launch 300 franchises across India in the next three years, DRIVE FITT aims to capture a significant share of a booming fitness market, projected to reach $4.5 Bn by 2030.

Backed by its holistic fitness approach and a premium tag, can DRIVE FITT outdo giants like Cult.Fit in the Indian fitness category?

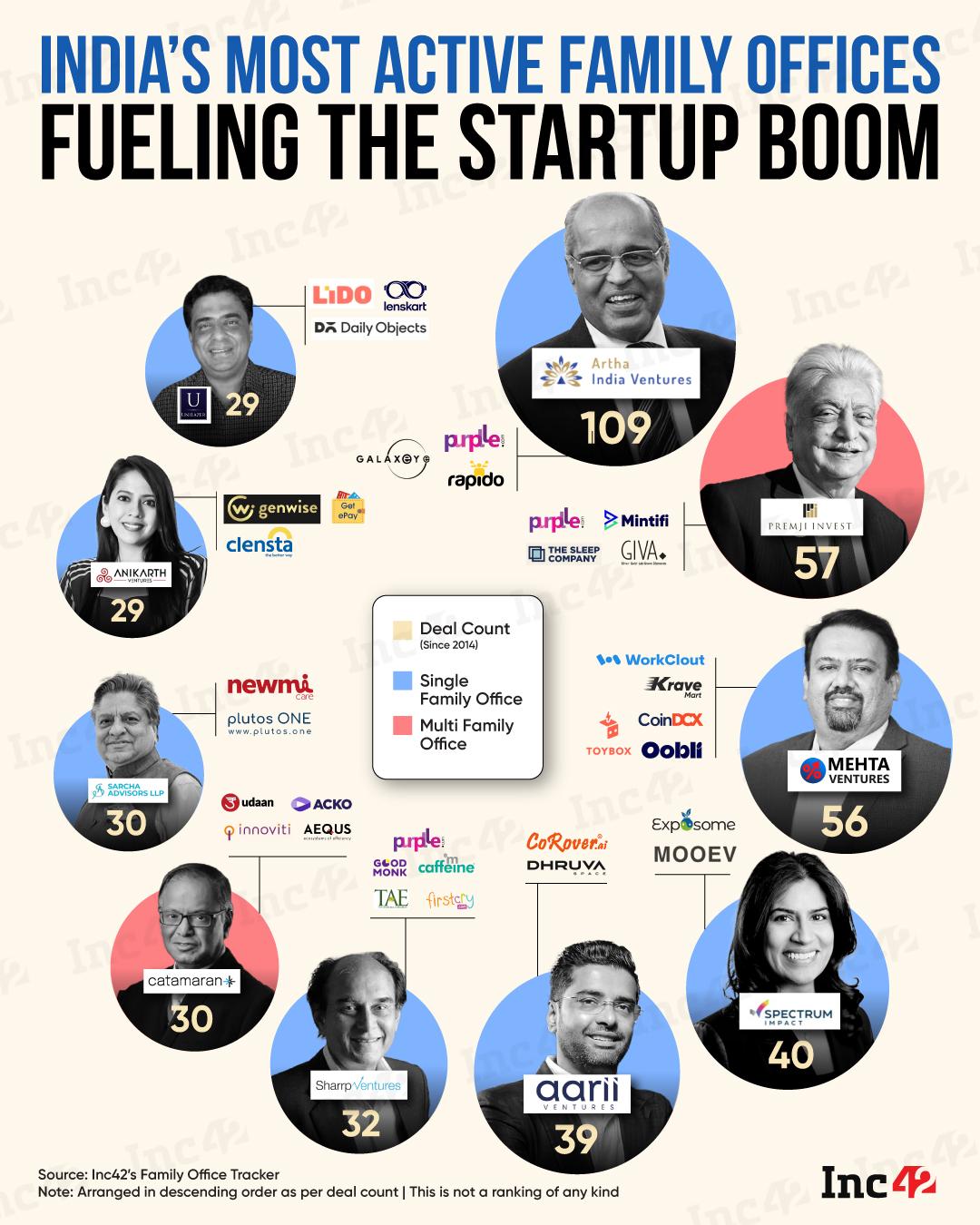

From Premji Invest to Artha India Ventures, here’s a look at the family offices turning capital into catalysts for change.

The post Startups & IPOs, A New Gaming Incubator & More appeared first on Inc42 Media.

You may also like

Shutdown breakers: Eight Democrats join Republicans to end deadlock — and they all have one thing in common

Zverev calls Shelton 'unbelievably aggressive player' player after win at ATP Finals

Pakistan amended its constitution, appointing Asim Munir as Commander of Defence Forces

Rachel Reeves 'plotting new £1.5 billion tax rise' in latest Budget hammer blow

Aneet Padda to start 'Shakti Shalini' after giving her college final year exams